gold coin ira

FollowOverview

-

Founded Date 31 August 1925

-

Sectors Creative and Design

-

Posted Jobs 0

-

Viewed 9

Company Description

Exploring the Newest Advances In Gold IRA Accounts: A Comprehensive Overview

In recent years, the idea of investing in a Gold Individual Retirement Account (IRA) has gained significant traction among buyers looking for to diversify their retirement portfolios. In contrast to traditional IRAs that typically deal with stocks, bonds, and mutual funds, Gold IRAs enable people to hold physical precious metals, resembling gold, silver, platinum, and palladium, as a part of their retirement financial savings. This text delves into the most recent advancements in Gold IRA accounts, highlighting their advantages, the evolving regulatory panorama, and the innovative solutions out there to buyers right this moment.

Understanding Gold IRAs

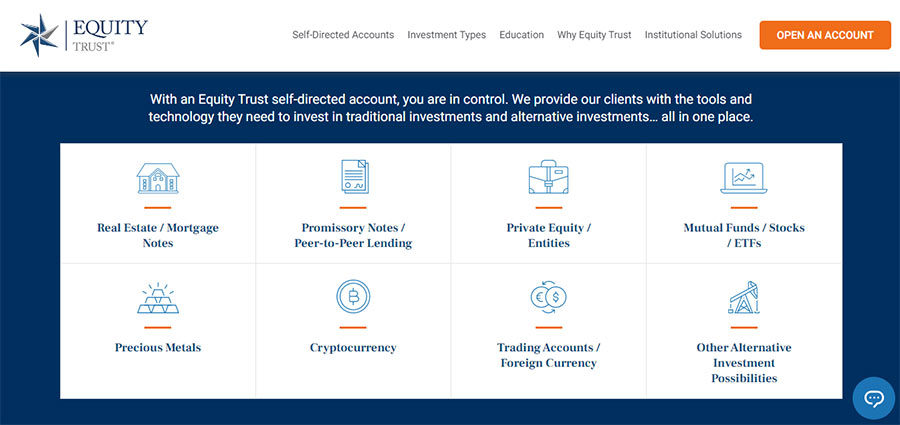

A Gold IRA is a self-directed retirement account that allows traders to include physical gold and different valuable metals in their retirement financial savings. The first allure of Gold IRAs is their potential to act as a hedge against inflation and economic uncertainty. Traditionally, gold has maintained its worth over time, making it a beautiful choice for those wanting to guard their property as traditional markets fluctuate.

Current Developments in Gold IRA Laws

One of the most significant developments within the realm of Gold IRAs has been the evolving regulatory framework governing these accounts. The internal Revenue Service (IRS) has established particular pointers concerning the types of metals that can be included in a Gold IRA, as nicely because the custodial necessities for managing these accounts.

Lately, the IRS has clarified its stance on sure bullion merchandise, permitting a broader range of gold coins and bars to be eligible for inclusion in Gold IRAs. This consists of widespread coins such because the American Gold Eagle, Canadian Gold Maple Leaf, and varied bars produced by accredited refiners. The elevated clarity in rules has made it easier for buyers to grasp their choices and has expanded the market for Gold IRA investments.

Technological Innovations in Gold IRA Management

One other notable advancement in the Gold IRA space is the integration of technology to streamline account administration and improve the overall investor experience. Many Gold IRA suppliers have adopted person-friendly online platforms that enable investors to easily manage their accounts, observe their investments, and execute transactions with minimal trouble.

These platforms usually function sturdy academic resources, including articles, videos, and webinars, designed to help traders understand the complexities of Gold IRAs. Moreover, some providers supply cellular apps that allow buyers to observe their portfolios in real-time, making it simpler to remain informed about market developments and make well timed selections concerning their investments.

Enhanced Security Measures

As the recognition of Gold IRAs continues to rise, so does the necessity for enhanced security measures to guard investors’ assets. Main Gold IRA custodians have carried out superior security protocols, including state-of-the-art vaulting solutions, to ensure the safekeeping of bodily valuable metals. These vaults are sometimes positioned in extremely secure services, often insured and monitored 24/7 to safeguard towards theft or harm.

Moreover, many custodians now provide insurance coverage insurance policies that cowl the worth of the metals held within the Gold IRA, offering investors with an added layer of safety. This give attention to safety not only helps to instill confidence in investors but in addition aligns with the rising demand for transparency and accountability in the monetary companies industry.

Diversification Choices Past Gold

While gold stays the most well-liked selection for Gold IRAs, recent developments have expanded the range of treasured metals that investors can embody in their accounts. Silver, platinum, and palladium have all develop into viable options for diversification within a Gold IRA, allowing buyers to spread their risk throughout a number of asset courses.

This diversification can be particularly helpful in instances of financial uncertainty, as completely different metals might reply differently to market circumstances. For instance, whereas gold typically serves as a secure haven throughout market downturns, silver has industrial applications that can drive its value in instances of financial progress. By together with a mix of treasured metals in their Gold IRAs, investors can higher place themselves to weather market fluctuations.

Aggressive Pricing and Decrease Fees

The elevated competitors amongst Gold IRA suppliers has led to more favorable pricing buildings and decrease charges for traders. Many custodians now provide transparent payment schedules, allowing buyers to clearly perceive the costs related to their Gold IRAs. This shift towards competitive pricing has made Gold IRAs more accessible to a broader range of traders, including those that could have previously been deterred by excessive fees.

Moreover, some suppliers have introduced modern charge constructions, resembling tiered pricing based on the scale of the funding, which may additional cut back costs for bigger buyers. This concentrate on affordability aligns with the rising trend of democratizing entry to precious steel investments.

Instructional Resources and Support

Because the Gold IRA market continues to evolve, so too does the emphasis on investor training. Many Gold IRA suppliers are actually prioritizing instructional initiatives to assist traders make informed choices about their retirement savings. This includes providing complete guides, market analyses, and personalized consultations with funding consultants.

By empowering traders with information, these providers intention to enhance the overall funding expertise and foster better confidence in Gold IRAs as a viable retirement technique. The emphasis on training not solely benefits individual buyers but also contributes to a more informed and responsible funding neighborhood.

Conclusion

The advancements in Gold IRA accounts mirror a broader trend toward diversification, security, and accessibility in retirement investing. With evolving rules, enhanced technology, aggressive pricing, and a give attention to education, Gold IRAs have develop into an more and more enticing option for investors seeking to guard their wealth and secure their financial futures. If you have any inquiries regarding where and ways to utilize gold ira investment, you could call us at the page. Because the market continues to develop, it is important for traders to remain informed about the most recent tendencies and alternatives within the Gold IRA space, ensuring they profit from their retirement financial savings. Whether or not you are a seasoned investor or new to the idea of Gold IRAs, the advancements available right this moment supply a promising avenue for constructing a robust and resilient retirement portfolio.